An Unbiased View of Three Things To Avoid When You File Bankruptcy

For anyone who is guiding on motor vehicle or dwelling payments, a Chapter 13 repayment can halt the foreclosure or repossession system, enabling you to receive caught up on payments and letting you keep the asset, supplied you make future payments on time.

For making this approach get the job done, you must demonstrate you have ample money to pay overdue amounts and keep on being recent on future payments. Learn more regarding your household and mortgage loan in Chapter thirteen bankruptcy.

Borrowing dollars from family or friends dangers harmful interactions, but as a last resort to avoid bankruptcy, it’s truly worth considering. If you're taking this route, enable it to be a penned settlement, established a payback plan, and stick to it regularly.

Should your goods and services is deemed avoidable, you could potentially put up with a catastrophic drop in profits. With no proper planning, it could spoil your company.

Bankruptcy isn't going to reduce pupil financial loans apart from in limited situations. Scholar financial loans might be discharged in bankruptcy provided that you show that repaying the loan would cause you "undue hardship," which is a very hard conventional to satisfy.

The trustee might also undo security passions and other pre-filing transfers that weren't carried out thoroughly. By way of example, transferring your property to some relative prior to filing bankruptcy might be treated being a fraudulent conveyance and undone by a trustee.

Sign up for Experian Strengthen®ø. Bankruptcy frequently leaves you with less credit history accounts, which could necessarily mean much less on-time payments on your best site credit score stories to market credit rating rating advancement.

But some of your home will probably be offered by a trustee to pay your creditors, so Chapter 7 bankruptcy is effective best For those who have little or no property.

Within a Chapter seven case, you must pay your legal costs up front As well as here in comprehensive before the case is finalized. In a Chapter thirteen situation, your legal fees may be incorporated into your payment plan.

Even even worse, you’ll get stuck with more service fees, more fascination payments, and a whole number of regret. Try to remember, you’re inside of a susceptible placement, and you will find Source folks available who will gladly take full advantage of that. Don’t slide prey to slick operators who are desperate to guarantee you a quick correct. Get help with your cash concerns. Talk with a Economic Mentor nowadays!

Filing for bankruptcy will also set a halt to foreclosure or legal actions against you, and it stops creditors check here from calling and demanding payment. This "respiratory House" is one of the most desired great things about filing bankruptcy.

To get a Chapter 7 bankruptcy, the discharge is normally issued anywhere from four to six months after the bankruptcy petition is filed. The discharge under Chapter thirteen bankruptcy is issued after the payment strategy is comprehensive, commonly three to 5 years following the bankruptcy filing.

Chapter 13 is for individuals with common money from wages or income who've adequate dollars to pay for their debts via get more a repayment approach. Within a Chapter thirteen bankruptcy, you are able to hold all of your house, but you will have to pay creditors the value of the "non-exempt" assets which include your automobile or boat.

Bankruptcy Trustee: This means, Overview, and Instance A bankruptcy trustee is appointed with the U.S. Trustee to characterize a debtor's estate in the course of a proceeding. The role differs based on the bankruptcy chapter.

Melissa Joan Hart Then & Now!

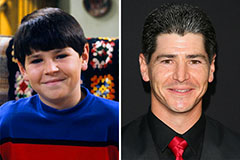

Melissa Joan Hart Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Barbara Eden Then & Now!

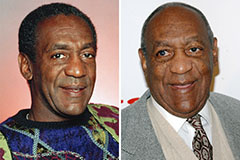

Barbara Eden Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!